£19 million a year – that’s the estimated total loss to scams each year in Northern Ireland, the Chair of the ScamwiseNI Partnership has said.

Furthermore, since the start of the year, 5,600 reports of attempted scams and scams were made to the Police Service, with many people left counting the cost for months and years to come.

Chief Superintendent Gerard Pollock, the Chair of the ScamwiseNI Partnership, said that the staggering statistics show just how ruthless scammers are.

Chief Superintendent Pollock said: “We should never lose sight of the fact that behind every loss, no matter what it has been, is a person or a business owner who has been taken advantage of in the most despicable and callous way. In some cases, the impact of the scam has life-long consequences.”

The biggest amount of money lost this year has been a person who lost £350,000 as a result of a cryptocurrency investment scam. Chief Superintendent Pollock says that while these may seem like a good way to boost savings, they are often high-risk investments with limited regulation or safeguards.

Chief Superintendent Gerard Pollock

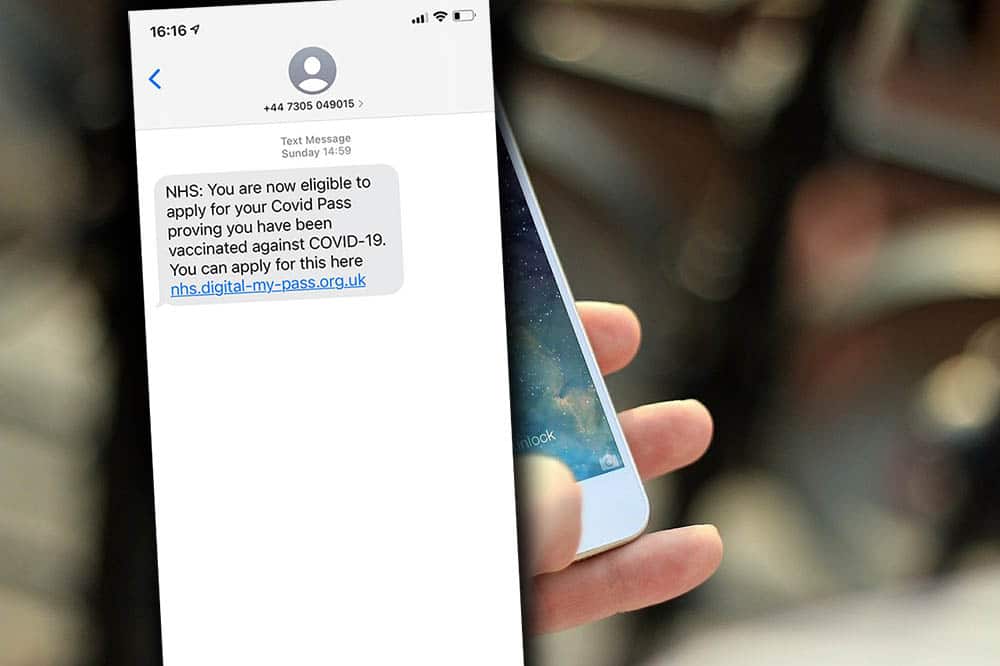

In terms of the types of scams, Chief Superintendent Pollock said most frauds and scams are committed at distance, with criminals exploiting communication networks through phones, social media, emails or text messages. These can include impersonation scams, where people are contacted online through WhatsApp, via text or online on Facebook, investment and romance scams and, more recently, cost of living scams.

However, he adds that there is rising awareness of frauds among the public, which is driving some of the reporting. Consequently, around 60% of the reports police receive do not involve any financial loss.

“I see how some people are more willing to report frauds and scams to the Police Service, but we do still see evidence of under-reporting in particular in those aged 19-39 years old,” he said.

From 2011-12, there has been a significant increase in the amount of fraud reported, from around 1,400 offences being reported to police in 2011-12 up to around 5,300 in the last financial year, 2021-22.

For some who lose money to scammers, the loss can be tens of thousands and, in some cases, hundreds of thousands of pounds.

Chief Superintendent Pollock said: “Due to the advances in technology, criminals can find their way into someone’s home, and access their banking and personal date without physically having to go to someone’s door.

“It’s important to remember anyone can be targeted by a scam and criminals will constantly change how they present their scam to lure people in, but the core is the same – they’re trying to get your personal and financial details.

“In recent months, we’ve also seen fake offers of refunds on utility bills, energy tariff discounts, energy rebates, tax rebates and cost of living payments all used by criminals.

“All of these scams are an attempt to get your personal details, such as your name, address, date of birth and who you bank with for your loss and their gain. This can then be used to commit a more sophisticated scam where the losses can be substantial.”

Police say that the best way to stop these scams is to apply five important rules:

- Never click on links in text messages from someone you do not know;

- Never call or text suspicious numbers back;

- Never ever transfer money to someone you do not know or have not met;

- Always delete texts requesting personal or financial information or bank account details;

- Always forward scam texts to 7726 – the free scam text reporting service.

If you have been a victim of a scam, report it to police on online at www.psni.police.uk/makeareport or call on 101, to your bank immediately, online at www.actionfraud.police.uk or call 0300 123 2040.

Information and advice is also available at http://www.nidirect.gov.uk/scamwiseni or the ScamwiseNI Facebook page @scamwiseni